Cars and watches. Watches and cars. If you’re speaking to a car enthusiast, I’d wager there’s a very good chance they’ll also appreciate the merits of a mechanical watch.

Listening to the brilliant Acquired podcast charting the history of Rolex, got me thinking. At various points, the excellent hosts Ben Gilbert and David Rosenthal, liken Rolex to Porsche. And it makes sense. If Audemars Piquet and Patek Philippe are the Ferrari or Bentley of the watch world, Rolex is the Porsche. And the Submariner is its 911.

In its dissection of the Rolex story, the episode navigates the quartz crisis of the late Seventies, when the likes of Casio and Seiko introduced watches that were more accurate than the finest Swiss movements at a fraction of the price. At a stroke, the mechanical wristwatch was functionally obsolete.

At its peak, the Swiss watch industry accounted for 85 per cent of the global market. By 1980 this had plummeted to just 15 per cent. Despite this, and the subsequent arrival of the smartwatch, Rolex and numerous others like it, thrive. Today, despite making only two per cent of the world’s watches, the Swiss industry captures 45% of the global revenue.

Listening to the story unfold, it struck me that the automotive industry is enduring its own quartz crisis, in the form of electrification. And rather than Japanese brands, it is Chinese manufacturers who are stealing a march on established brands with better tech and cheaper prices.

There is a big difference here, though. While Rolex and its watchmaking peers could lean into the craftsmanship of their mechanical watches and market them as luxury items of absolute desire, the likes of Porsche are facing an uncertain future as the decades of expertise it has amassed developing internal combustion engines could count for nothing thanks to legislation banning their sale altogether.

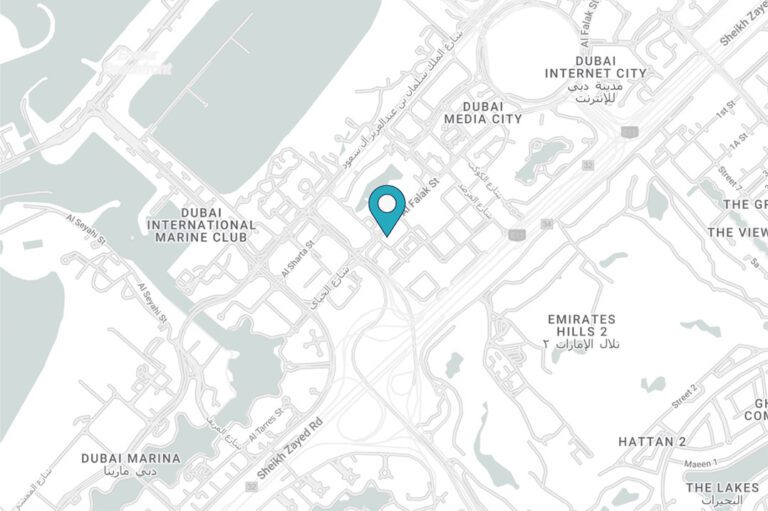

eFuels – synthetic fuels that do not rely on fossil fuels and pose the tantalising prospect of carbon neutrality – could be the answer. Eager to copy the Rolex playbook, Porsche is on the case. Last year, its entire grid of Supercup racers competed using eFuel, and the race is on to industrialise its energy-intensive production.

In reality, given its likely cost, eFuel will probably be for the enthusiast, rather than mass, market. But that could still allow Porsche and its peers to continue producing cars that, while slower and more complex than the latest EVs, command much higher prices.

Saudi oil giant Aramco is working hard to make synthetic eFuels a reality, with labs in Paris, Detroit and Shanghai all developing low-carbon solutions. So convinced is it in the future of the ICE engine, it recently took a 10 per cent stake, worth €740mn, in Horse Powertrain – a company dedicated to building fuel-based engines.

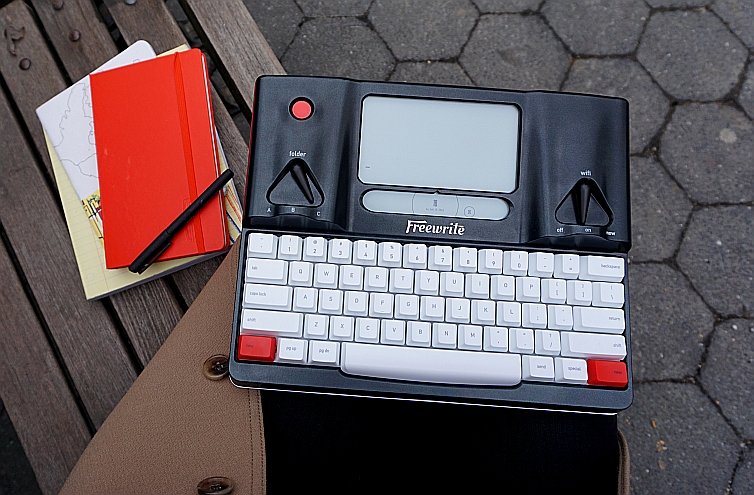

If legislators do prevent the flat-six from assuming the same universal technological contrariness as a perpetual mechanical watch movement, the fortunes of the Taycan signal the scale of the challenge facing Porsche. The brand’s first foray into the EV space prompted a volte-face and regime change in the boardroom as it re-embraced ICE engines.

Whether you’d classify this strategy as a marketing masterstroke or an existential requirement is hard to say, right now, but a Porsche with a flat six sounds better in every possible sense. I won’t be alone in hoping eFuels give the combustion engine a stay of execution. And if it happens, another Rolex parallel is likely to be drawn – as lengthy waiting lists for any kind of 911 (not just the GTs) would doubtless become the norm. Along with another Rolex staple: the assurance of sky-high resale values straight out of the showroom.

Ross Pinnock